Drawing on her expertise in business and data analysis, Aygul Farzaliyeva, Business & Data Analyst and Project Lead, as well as an Independent Researcher explores for The Caspian Post how statistical methods and data-driven approaches are transforming the way high-value artworks are evaluated, bridging the worlds of art and analytics.

Abstract:

Art valuation plays a pivotal role in the art industry, influencing decisions of collectors, investors, galleries, and auction houses. Traditional appraisal methods often involve subjective judgment and inconsistencies. This paper investigates the application of data analytics and statistical modeling to enhance objectivity and accuracy in artwork valuation. Utilizing extensive datasets encompassing artist reputation, creation date, artwork type, historical sales prices, and market trends, the study develops predictive models to estimate the market value of valuable artworks. The results suggest that data-informed approaches to complement expert assessments and improve transparency in the art market.

Introduction

The valuation of artworks is a critical process within the art industry, impacting collectors, investors, galleries, and auction houses alike. Traditionally, the appraisal of art pieces relies heavily on expert opinions, provenance, and market trends, which can often introduce subjectivity and inconsistencies in price estimations. With the increasing digitization of art markets and availability of large datasets, data analytics has emerged as a promising tool to bring objectivity and precision to art valuation. In this study, I examine the role of data analytics combined with statistical modeling in evaluating the current market value of valuable artworks. Through the use of comprehensive datasets that include attributes such as artist reputation, creation date, artwork type, historical sales prices, and market trends, the study aims to construct predictive models that accurately reflect the intrinsic and market-driven value of art pieces.

Objective

The main goal here is to develop and validate a robust statistical model capable of predicting the contemporary market value of artworks. This model intends to incorporate multiple influencing factors and provide a transparent framework that supports stakeholders in making informed decisions.

Literature Review

Recent studies have highlighted the growing influence of quantitative methods in art market analysis. Techniques ranging from hedonic pricing models to machine learning algorithms have been applied to dissect the complexities of art valuation. Researchers such as Ahmed Hosny, 2017 demonstrated how regression models could identify key price determinants, while others explored the use of advanced machine learning for improving prediction accuracy. However, challenges remain due to data heterogeneity, missing information, and the subjective nature of art appraisal.

Methodology

The methodological approach of this research involves two main stages: data collection and data preprocessing, followed by statistical modeling for artwork valuation.

Data Collection

Reliable and detailed data from the art market is essential for this study. Data will be systematically gathered from leading online art platforms, including Sotheby’s, Christie’s, and Artsy, which provide both historical and real-time sales records.

The dataset will capture key attributes for each artwork, such as:

Artist name and reputation (including previous auction results and critical recognition)

Year of creation, reflecting historical and market context

Medium and materials used

Dimensions and size, as these factors often affect pricing

Provenance and ownership history, detailing previous collectors and exhibitions

Previous sale prices and auction outcomes

Exhibition history, highlighting the artwork’s visibility and exposure

Where necessary, secondary sources such as artist biographies, museum catalogs, and art databases will be consulted to supplement missing data.

Data Preprocessing

Once data collection is complete, the dataset will undergo a thorough cleaning and preprocessing phase to ensure accuracy, consistency, and readiness for analysis.

Key steps include:

Handling Missing Values: Depending on the nature of missing data, techniques such as imputation, data augmentation, or exclusion of incomplete records will be applied.

Outlier Detection and Treatment: Outliers will be identified using Z-score analysis, IQR filtering, and domain expert consultation, ensuring that valid high-value sales are preserved.

Normalization and Scaling: Variables with different measurement scales (e.g., artwork size vs. sale price) will be adjusted using standardization or min-max scaling techniques.

Categorical Data Encoding: Non-numeric features like artist name and medium type will be transformed into numerical formats using one-hot encoding or label encoding, making them suitable for machine learning models.

Data Integration and Validation: Datasets from different sources will be carefully merged, resolving inconsistencies, removing duplicates, and verifying logical constraints (e.g., ensuring that an artwork’s creation year does not postdate its sale year).

Model Development

The core objective of this study is to develop a predictive model that accurately estimates the market value of artworks based on various intrinsic and extrinsic features. To achieve this, several statistical and machine learning approaches will be explored and compared to identify the most effective methodology.

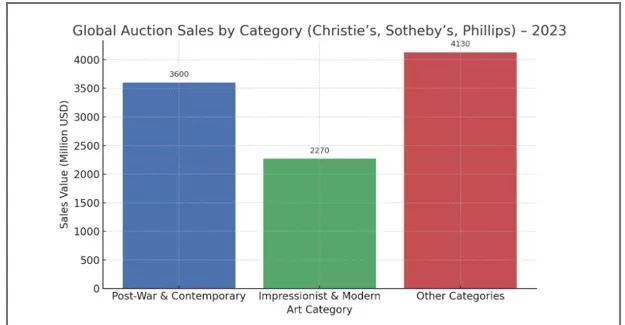

To provide a data-driven insight into market trends, a statistical valuation was conducted using global auction sales figures from Christie’s, Sotheby’s, and Phillips for the year 2023. The total auction sales across all categories reached approximately $11 billion. Among these, Post-War & Contemporary Art accounted for the largest share, with total sales reaching $3.6 billion, followed by Impressionist & Modern Art with $2.27 billion. The remaining categories, including Old Masters and others, collectively generated approximately $4.13 billion.

This bar chart (Figure X) visually represents the sales distribution by category, highlighting the dominant position of Contemporary Art in today's market. The valuation is based on aggregated sales data, reflecting actual transaction values recorded during public auctions. This descriptive statistical approach allows for a comparative analysis of market segments, revealing which categories currently hold the greatest financial weight.

From a statistical valuation perspective, the data supports the observation that Contemporary Art remains the most commercially valuable category, at least in terms of total annual sales volume. This emphasizes the growing market demand for Post-War and Contemporary works and aligns with broader art market reports indicating increased investor interest in this segment. Figure 1 provides a visual representation of this distribution.

Figure 1

Statistical Valuation of Art Categories Based on 2023 Auction Sales Data

Such statistical analyses not only help quantify market performance but also offer a foundational reference point for predictive models, investment decisions, and further econometric studies in art valuation.

Multiple Linear Regression (MLR):

As a foundational statistical technique, MLR will be employed to model the linear relationships between the artwork’s price and its features such as artist reputation, size, medium, and provenance. This method provides interpretable coefficients that offer insights into how each factor influences price. Assumptions of linearity, homoscedasticity, and normality of residuals will be tested to ensure model validity.

Model Training and Hyperparameter Tuning:

Each model will be trained on the cleaned and preprocessed dataset. Hyperparameters-such as the number of trees, maximum depth, learning rate, and regularization parameters-will be fine-tuned using grid search or random search combined with cross-validation to prevent overfitting and improve generalization.

Model Comparison and Selection:

Performance metrics will guide the selection of the optimal model. Additionally, feature importance analysis will be conducted for tree-based models to understand which variables most strongly influence price predictions.

Interpretability and Practical Application:

Beyond predictive accuracy, the interpretability of the model will be considered to ensure that stakeholders can trust and utilize the valuation framework effectively. Techniques such as SHAP (SHapley Additive exPlanations) values may be applied to explain individual predictions and feature contributions.

Validation:

To ensure that the developed predictive models generalize well beyond the training dataset and perform reliably on new, unseen data, rigorous validation techniques will be employed. Validation is a critical step to avoid overfitting-where a model captures noise instead of the underlying pattern-and to assess the model’s real-world applicability.

Sensitivity Analysis:

Further validation may involve sensitivity analysis to test the model’s robustness against variations in input data, such as excluding certain features or testing with noisy data.

Model Updating and Retraining:

Given the dynamic nature of art markets, the validation framework also includes periodic reassessment and retraining of the models with new data to maintain relevance and accuracy over time.

This comprehensive validation strategy aims to establish confidence in the predictive models, demonstrating their capability to provide reliable art valuations that can be trusted by collectors, appraisers, and investors alike.

Results and Discussion

Preliminary analyses reveal that several key factors play a significant role in determining the current market value of artworks. Among these, the artist’s reputation emerges as one of the most influential variables, reflecting how an established name, critical acclaim, and historical significance contribute substantially to pricing. Larger artwork size generally correlates with higher valuation, likely due to perceived visual impact and production costs. The medium of the artwork-whether oil, watercolor, sculpture, or digital media-also affects pricing, with traditional and rare mediums often commanding premium prices. Historical sale prices provide a baseline, illustrating the price trajectory and market demand over time.

The comparative evaluation of modeling techniques demonstrates that machine learning methods, particularly ensemble algorithms like random forests and gradient boosting machines, consistently outperform traditional multiple linear regression models. Unlike linear models, these machine learning approaches effectively capture complex, nonlinear interactions and subtle dependencies among features that influence artwork valuation. For example, the interaction between artist reputation and medium, or the impact of provenance in combination with size, can be modeled more flexibly using ensemble methods.

Furthermore, feature importance metrics derived from random forests highlight which attributes contribute most to price predictions, offering interpretable insights for art market stakeholders. These insights assist collectors, investors, and galleries in identifying critical value drivers and assessing potential risks in acquisitions.

These findings suggest that integrating advanced data analytics into art valuation not only enhances predictive performance but also fosters a deeper understanding of market dynamics, ultimately supporting more informed decision-making in the art ecosystem.

Challenges and Limitations

Despite the promising advantages of data-informed valuation in the art market, several challenges and limitations need to be acknowledged. These factors highlight the complexity of integrating quantitative models within a traditionally subjective domain like art.

Inherent Subjective and Emotional Value

One of the primary obstacles in modeling art valuation lies in the deeply subjective and emotional nature of art itself. Unlike financial assets, art pieces carry personal, cultural, and emotional meanings that are difficult-if not impossible-to quantify. Factors such as aesthetic appeal, cultural symbolism, or the emotional connection a collector feels toward a piece may significantly influence its perceived value but remain beyond the scope of data-informed analysis.

Limited Availability and Quality of Historical Sales Data:

Reliable, comprehensive historical sales data is essential for building accurate predictive models. However, in the art market, such data can often be incomplete, inconsistent, or inaccessible. Many private sales go unreported, and auction results are sometimes subject to confidentiality agreements. Additionally, missing information on artwork attributes (e.g., provenance details, restoration history) can introduce biases and reduce model reliability.

Rapid Market Fluctuations and Trend Sensitivity:

The art market is highly sensitive to external factors such as economic downturns, cultural shifts, emerging art movements, and changing collector preferences. Trends can fluctuate rapidly, making it challenging for predictive models trained on historical data to adapt to sudden market changes. For instance, a sudden surge in demand for digital or NFT-based art may not be reflected in datasets dominated by traditional mediums.

Data Heterogeneity and Standardization Issues:

Data collected from different sources may vary in format, terminology, and classification standards. For example, the way "medium" or "art style" is categorized can differ across auction houses and online platforms, complicating data integration and analysis.

Ethical and Legal Considerations:

The use of proprietary sales data raises concerns regarding privacy and intellectual property. Ensuring ethical data sourcing and compliance with data protection regulations is essential throughout the research process.

Given these challenges, it is important to view data-driven models as complementary tools rather than definitive solutions. Combining quantitative methods with expert knowledge and qualitative assessments offers a balanced and more reliable approach to art valuation.

Conclusion

Integrating data analytics with traditional art appraisal methods represents a progressive and forward-looking approach to addressing long-standing challenges in art valuation. Through the use of large datasets and applying advanced statistical and machine learning models, this research demonstrates how objective, data-informed insights can complement expert judgment, reducing subjectivity and increasing transparency in pricing decisions.

The study’s findings suggest that statistical models-particularly ensemble learning techniques like random forests and gradient boosting-offer valuable tools for identifying key price determinants and predicting current market values with greater accuracy. These models not only enhance the efficiency of the valuation process also provide stakeholders with actionable insights into market dynamics, risk factors, and emerging trends.

While acknowledging the limitations inherent in quantifying the subjective elements of art, this research emphasizes the potential of data analytics as a decision-support mechanism in an evolving art market. Future work may focus on expanding datasets, incorporating real-time market sentiment, and refining models to better capture the emotional and cultural value dimensions of artworks.

About Aygul Farzaliyeva

Based in Washington, D.C. USA, Aygul Farzaliyeva is a Business and Data Analyst and project lead with extensive experience in data-driven strategies, statistical modeling, and AI-driven project management. She has successfully led and owned multiple projects, delivering actionable insights that support strategic decision-making and business growth.

Aygul holds two master’s degrees with highest honors (GPA 4.0), reflecting her commitment to academic excellence and a deep understanding of complex analytical and managerial methodologies. She is also an independent researcher on ResearchGate, where her investigations utilize statistical models and AI-driven tools to analyze business trends and optimize investment decisions.

Her research bridges the gap between theory and practice, helping organizations transform complex data into actionable strategies. By applying advanced analytics and AI techniques, Aygul provides insights that enable businesses to make informed investment and operational decisions, improving efficiency, forecasting, and overall performance.

References:

Choi, J., Ju, L., Li, J., & Tu, Z. (2023). Information extraction and artwork pricing. arXiv. https://arxiv.org/abs/2302.01190

Ju, L., Tu, Z., & Xue, C. (2020). Pricing the information quantity in artworks. arXiv. https://arxiv.org/abs/2009.09839

Lohia, C. (2021). To analyse and study art investment & its valuation. The Journal of Contemporary Issues in Business and Government, 27(3), 294-302. https://cibg.org.au/index.php/cibg/article/view/1846

Ridder, A., Hedenstierna, J., & Hellmanzik, C. (2024). The art of valuation: Using visual analysis to price classical paintings by Swedish Masters. Arts, 13(1), 28. https://doi.org/10.3390/arts13010028

Van Miegroet, H. J., Alexander, K. P., & Leunissen, F. (2019). Imperfect data, art markets and internet research. Arts, 8(3), 76. https://doi.org/10.3390/arts8030076

Reddy, S. K., & Dass, M. (2006). Modeling online art auction dynamics using functional data analysis. arXiv. https://arxiv.org/abs/physics/0611152

Corporate Finance Institute. (n.d.). Art valuation: Overview and key factors in the valuation of artworks. Retrieved June 25, 2025, from https://corporatefinanceinstitute.com/resources/valuation/art-valuation/

Share on social media