In October, the Consumer Confidence Index (CCI) improved in two Central Asian countries.Kazakhstan demonstrated growth for the second month in a row and the best result in 2024. In Uzbekistan, the growth rate accelerated after the September decline, and the index turned out to be the highest since March of this year.

Photo by: © The Press Service of the President of the Kyrgyz Republic / Sultan Dosaliev

For the sixteenth month, Freedom Finance Global has been researching consumer confidence, inflation and devaluation expectations of residents of four Central Asian countries: Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan. In October 2024, the dynamics of consumer confidence are ambiguous. Growth occurred in only two countries, and the changes were mostly quite significant. However, the dynamics of inflationary sentiments have improved noticeably in almost all countries, although a couple of countries are still far from recovery. On the other hand, devaluation expectations in the region have grown almost everywhere amid weakening national currencies, The Caspian Post reports citing foreign media.

In October, the Consumer Confidence Index (CCI) improved in two Central Asian countries. Kazakhstan demonstrated growth for the second month in a row and the best result in 2024. In Uzbekistan, the growth rate accelerated after the September decline, and the index turned out to be the highest since March of this year. On the other hand, Kyrgyzstan demonstrated a decline in the index for the second month in a row after its recent rapid growth, and it turned out to be much more significant. In Tajikistan, the decline was small, but at the same time, residents’ opinions have changed dramatically on certain issues over the past month.

In Kazakhstan and Uzbekistan, analysts collect 3,600 questionnaires each month, 1,600 in Kyrgyzstan and 1,200 in Tajikistan, pro rata the size of the population in the countries under research. The research is based on the methodology used to obtain consumer confidence indexes in many countries around the world and adapted to local needs by the United Research Technologies Group company. Data collection method: telephone survey. The survey questionnaire is localized: the research is conducted in the native language of the respondents.

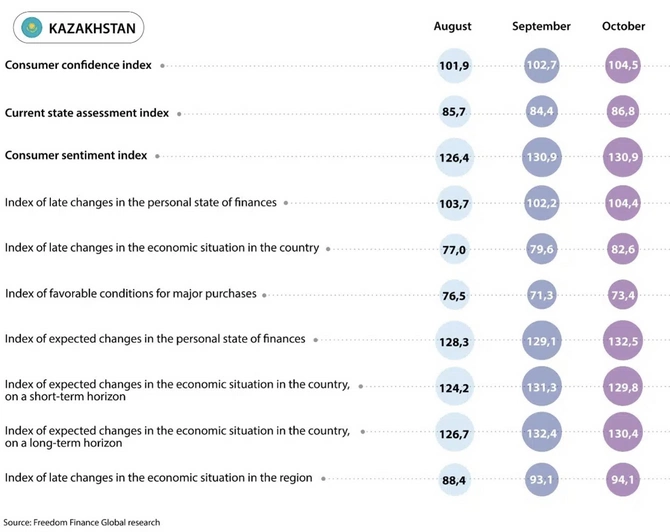

Kazakhstan

In Kazakhstan, the Consumer Confidence Index demonstrated growth for the second month in a row in October and reached 104.5 points, which was the best indicator in 2024. The improvement in respondents’ sentiments occurred in four out of five sub-indexes. The largest increase occurred in forecasts of changes in personal financial situation over a one-year horizon. Compared to last October, the CCI increased by 1.2 points, largely due to a significant improvement in estimates of changes in the economic situation.

Improving personal financial situation forecasts

The sub-index of the forecast of changes in personal financial situation over the next 12 months increased by 3.4 points and reached 132.5 points, which is the best result of 2024. The share of those who believe that their personal financial situation will improve increased from 48.1% in September to 50% in October.

Among the age groups, however, the growth of optimism is not occurring in all groups. The strongest growth is recorded in the 45-59-year-old group, where the share of positively minded respondents increased from 39.6 to 45.1%. Nevertheless, the best result is still shown by young people under the age of 29, among whom the same share increased from 63.4 to 67.1%. While, among the older generation from 60 years old, on the contrary, an increase in pessimism is recorded: only 31.1% of people chose positive answers against 35.2% in September.

In the regional context, the greatest increase in positivity in forecasts of changes in personal financial situation is observed in Akmola and West Kazakhstan regions, where the share of positive responses increased by 13.7 and 13.5 p.p., respectively. Nevertheless, the Kyzylorda region continues to be the leader, where the share of those predicting an improvement in personal financial situation in the next 12 months was 61.6%. The worst response was in the Ulytau region, where this indicator, on the contrary, fell from 46 to 23.3%.

Strongest optimism in the economy over the past year

Compared to September, the sub-index of estimating changes in the economy also showed a noticeable improvement growing by exactly 3 points and amounting to 82.6 points. This result is the highest since November 2023. The share of Kazakhstanis who believe that favorable changes have occurred in the economy increased from 17.4 to 18.7%. However, the decrease in the share of negative responses is more noticeable: from 42.4 to 39.6%.

Among the age groups, the greatest increase in optimism was demonstrated by young people under the age of 29. The share of positive responses increased from 19.6 to 23% among their representatives. It was the best result among age groups. At the same time, the changes were insignificant in other age groups. The worst responses were given by respondents aged 45–59, among whom only 16.7% noticed an improvement in the economy over the past year. However, the result for the 30–44 age group was slightly higher (16.9%).

In the regional context, the greatest progress was shown by the Zhambyl region, where the share of positive responses increased from 15.5 to 28.1%. This result was also the best among all regions in October. A large monthly increase was also recorded in Almaty and West Kazakhstan regions, where the same indicator increased by 7.1 p.p. On the other hand, respondents from the Ulytau region responded the worst, where the share of positive responses fell from 13.8 to 9.3% over the month.

Inflation estimates have fallen to lows

Inflation estimates of Kazakhstan residents fell again in October after a noticeable increase in September. Over the past month, 37.5% of respondents (39.7% in September) indicated a strong increase in prices. Over the past year horizon, there was an even more significant drop in the share of those who noticed a rapid increase in prices: from 50.8% in September to 47.5% at the time of the last data collection. It should be noted that both indicators turned out to be a record minimum for the entire research.

However, the inflation expectations of Kazakhstanis, on the contrary, showed growth compared to September and updated the highest values this year. The share of people expecting a strong increase in prices in the one-month horizon increased from 19.9 to 21.9%, while in the next 12-month horizon, the share of those expecting an acceleration in price growth increased from 24.9% in September to 25.4% at the time of the last survey.

A similar survey of inflation estimates and expectations by the National Bank of Kazakhstan also demonstrated a decrease in inflationary pessimism updating multi-month lows. According to the presented data, the share of those expecting strong price growth during the year fell from 24.3% to 19.9%. While in the one-month horizon, the same indicator fell from 19.5% to 18.1%. Inflationary estimates also demonstrated a significant decline. While the share of respondents noticing price growth over the past month has decreased from 29 to 27.9%, the share of those indicating rapid price growth over the previous 12 months has decreased from 42.7 to 39.4%, which is the lowest value since January 2019.

Among certain goods and services, most respondents are still concerned about the significant increase in food prices. The list of the top 4 goods, whose prices have most noticeably increased for the population, has remained unchanged over the past year. It includes the categories ‘Meat and Poultry’, ‘Milk and Dairy Products’, ‘Bread and Bakery Products,’ and “Vegetables and Fruits”. Despite the decrease in inflation estimates, on average, the share of people who noticed a strong increase in prices for all of the above products increased by 2.2 p.p. compared to September. For meat and poultry, the share indicator increased from 36.1 to 40.2%, which was the third result this year. The share of people who chose fruits and vegetables also increased significantly (+3.5 p.p.), which is due to the end of the seasonal price reduction. According to official statistics, prices for meat and poultry increased in October by only 0.2% MoM. Fruits and vegetables fell in price by 0.3% compared to September, although certain items (cucumbers, tomatoes, citrus fruits) rose by 7–10% MoM.

Devaluation expectations hit new records

Devaluation expectations of Kazakhstanis increased significantly in October and reached new record values for the entire research amid an increase in the US dollar exchange rate to 496 tenge at the moment. According to the survey, the share of Kazakhstanis expecting the tenge to weaken over a one-year horizon increased from 57.5 to 59.3%. Over a one-month horizon, there was an increase from 35.2 to 40.5%. We would like to note that the share of pessimists increased by 5.4 p.p. for the first question and by 6.1 p.p. for the second question compared to October 2023.

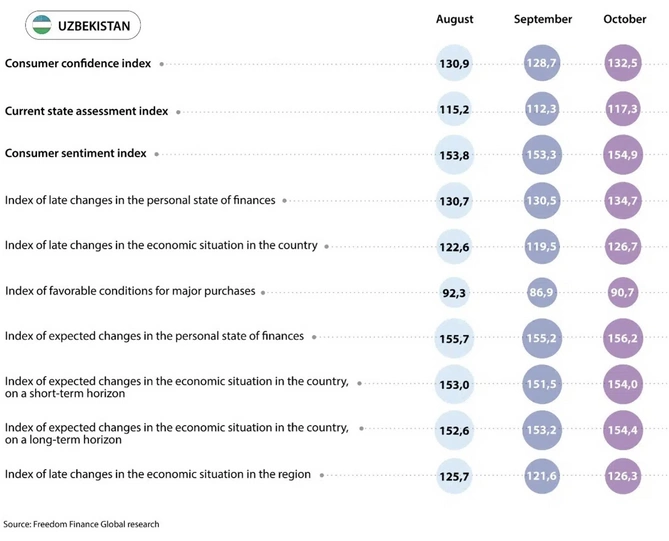

Uzbekistan

The Consumer Confidence Index of Uzbekistan residents showed a good recovery in October 2024 after the September decline and increased from 128.7 to 132.5 points. Separately, the improvement occurred in all five sub-indexes that determine the index. The sub-index of changes in the economic situation showed the greatest growth. However, the CCI fell by 1.9 points compared to October 2023, largely due to a drop in optimism regarding the economic situation.

Opinions about the economic situation have greatly improved

In October, the sub-index of changes in the economic situation showed the greatest growth. It grew by 7.2 points and reached 126.7 points, which is the best result in the last seven months. Almost 55% of Uzbekistan respondents believe that the economic situation has improved over the previous year, which is 5 p.p. more than the September figure.

Noticeable positive dynamics are observed among all age groups. The greatest change was recorded among people aged 45–59, 56.8% of whom believe that the economic situation has improved, while such respondents accounted for 50.1% in September. The best result continues to be shown by the older generation from 60 years old, where this share reached 57.5%. Young people under the age of 29 are in the last positions, where the indicator increased from 46.9 to 53.1% in October.

In the regional context, the most noticeable improvement (compared to September) is recorded in the Jizzakh, Bukhara and Samarkand regions, where the share of positive responses increased by 15.6, 11.6 and 8.9 p.p., respectively. At the same time, the other regions do not show any significant changes. Nevertheless, the Khorezm region continues to be the leader with a share of positive responses of 64.2%. While the outsider also did not change, and it is still Tashkent, where the same indicator increased by only 0.1 p.p. and amounted to 37%.

More optimism about personal financial situation

Another sub-index that grew significantly in October was the change in personal financial situation over the past year. The previous level increased by 4.2 points, and the indicator also demonstrated the best result in seven months. Over 62% of Uzbekistan residents chose the positive answer, while there were 57.7% in September.

Among the age groups, young people under the age of 29 demonstrated the best estimates. If the share of positive answers in this group reached 67.4% in the previous month, then it grew to 73% in October, which is the highest result among all surveyed categories. Respondents over 60 years old still demonstrated the worst result; there were 49.1% optimists among them, which is 2.4 p.p. higher than in September. The dynamics of the other two age groups turned out to be average. The share increased by 4.7 p.p. among people aged 30–44, and by 3.8 p.p. among residents aged 45–59.

In the regional context, the greatest improvement in the indicator occurred in the Bukhara region. The share of respondents who chose positive answers increased from 60.8 to 70.1% there. It was the best regional result. The share also increased by a noticeable 8.6 p.p. in the Fergana region. Only the Surkhandarya region showed negative dynamics in October, where the share of positive answers fell from 62.1 to 57.9%. Yet, Tashkent continues to be an outsider in this matter with an indicator of 54.1%.

Inflation expectations and estimates declined along with official inflation

Inflation estimates and expectations of Uzbekistan residents showed a general decline in October. Thus, in October, 48.6% of residents felt a very strong increase in prices over the past year against 51.4% in September. However, over the past month, their share fell from 31.8 to 29.9%.

At the same time, inflation expectations showed a slight improvement compared to September. The share of those expecting a strong price increase in the next month fell from 19.6 to 18.8%. In the one-year horizon, 24.2% of respondents expect faster price growth, which is 1.4 p.p. lower than the September figure and is generally the lowest value for the entire research.

According to official statistics, a monthly price increase of 0.84% was recorded in October. Amid the above, annual inflation has noticeably decreased from 10.46 to 10.24%. We noted the slowdown in the monthly growth of meat prices. The growth rate has fallen to about 1% after figures of 3 and 5 times higher in September and August, respectively. Nevertheless, this continues to have a noticeable impact on the sentiments of respondents. Over 60% of respondents indicated meat and poultry as a product for which a strong price increase is noticeable, while there were 61.9% in September. We noted a slight decrease in this indicator for housing services and utilities (-3.3 p.p.) and flour (-2.6 p.p.). Flour showed the lowest result for the entire research, although it was in second place a year ago. It should be noted that, according to official statistics, housing services and utilities increased in price by only 0.3% MoM in October, while the price of flour has decreased by 2.6% over the past year. Moreover, a small monthly increase in the price of vegetables and fruits did not affect the sentiments of respondents.

Continued growth of devaluation expectations

In September, devaluation expectations of Uzbekistan residents continued to grow after a sharp increase in September. The Uzbek sum showed a weakening of 0.6% for the third month in a row in October. The share of those who expect the national currency to weaken against the US dollar over the next 12 months increased from 59.4% in September to 60.5% in October. However, in the one-month horizon, the share of pessimists increased from 41.2 to 42.7%. These figures have become the highest in the last 5 months, but they are still below the levels of October 2023.

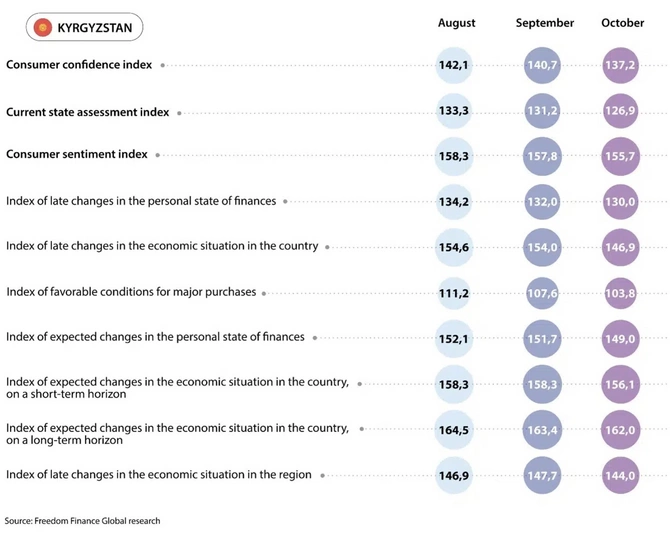

Kyrgyzstan

In Kyrgyzstan, the Consumer Confidence Index showed a decline in October for the second month in a row. The index (CCI) fell by 3.6 points in a month and reached 137.2 points. This time, all five sub-indexes that determine the index composite level showed a decline. The largest decline is recorded in the matter of estimating changes in the economic situation over the past 12 months. However, the index grew by 8 points compared to October 2023 after a strong improvement in the first half of 2024.

Estimates of the economic situation have worsened

The sub-index of estimates of changes in the economic situation over the past 12 months showed the largest monthly decline. It is worth noting that this sub-index was the main driver of the recent strong growth in consumer confidence. It fell by 7.2 points in October. More than 67% of residents indicated an improvement in the economic situation, while this figure reached 71.7% in September.

Among the age groups, the decline is observed across the entire spectrum, but the deterioration was formal among the older generation. Over 72% of the country’s residents over 60 years old noted an improvement in the economic situation, while there were only 0.1 p.p. more of them in September. This result became the best in October. However, respondents aged 45–59 were at the end of the list, the share of positive answers fell sharply from 74.3 to 64.3% among them. The decline in the other two age groups was small and amounted to 2.3–3.1 p.p.

In the regional context, there is also a multidirectional dynamics in improving estimates of changes in the economic situation. The leader of October and the one that showed the greatest increase in the share of positive responses was the Talas region, where the indicator increased from 69.7 to 80.5%. This region took over the leadership from the Batken region, where the same share fell by 9.3 p.p. The share also decreased significantly in Bishkek and the Naryn region by 10.7 and 10.5 p.p., respectively. Finally, residents of the capital responded the worst: only 50.7% of them noted positive changes in the economy.

Another reduction in estimates of favorable conditions for large purchases

The sub-index of current favorable conditions for large purchases has been falling for the third month in a row and has become lower by another 3.8 points compared to September, and reached a level of 103.8 points. Yet, it is still the highest value in Central Asia. The share of people indicating favorable conditions for large expenses increased from 43.5% in September to 44.4% in October. Nevertheless, the share of clearly positive responses decreased by 2.1 p.p., and the share of negative responses increased by 4.4 p.p.

All age groups showed an increase in pessimism, but it was most noticeable among respondents under 29. There, the share of people who consider the current conditions for large purchases as unfavorable increased from 29.4 to 36.3%. Nevertheless, it was the lowest value among all age groups. The largest share of pessimists was recorded among people aged 45–59, whose similar indicator increased from 36.1 to 40.5%.

It should also be noted that the increase in the share of negative responses is observed in all regions of the country. The strongest growth is observed in the city of Osh, where the share of negative responses increased by 14.3 p.p. However, residents of the Talas region gave the worst responses, a share of those who noted unfavorable conditions for large purchases was 46.6%. While, this indicator turned out to be the best in the Naryn region and amounted to only 27.5%, despite an increase in the share of pessimists by 10.5 p.p.

Inflation estimates and expectations demonstrated a decline

Inflation estimates of Kyrgyzstanis showed a noticeable decrease in October after a sharp increase in September. If 30.8% of respondents felt a very strong increase in prices over the past month in September, then such figures were 26.6% in October. Estimates of price growth over the past 12 months also fell. In October, 47.8% of Kyrgyzstanis noted an acceleration in price growth, while this figure was 50.7% in September. Official October data on annual inflation indicate its slowdown from 4.9% to 4.8% after a sharp rise in September.

Inflation expectations of Kyrgyzstanis have not fallen as significantly as inflation estimates, and even generally remained at the same relatively low levels. The share of respondents expecting a faster increase in prices in the next 12 months has increased from 12.9 to 13.7%. The share of those who believe that prices will rise very strongly in the next month, on the contrary, has fallen from 8.7 to 7.7%.

Among the certain goods and services for which residents noticed the greatest price increase, as in other Central Asian countries, we again note the category ‘Meat and Poultry’, which held first place for the second month in a row. However, the share of respondents who chose it fell from a record 51.6% to 47.7%. At the same time, flour is slightly behind in this indicator, and reached 47.2% in October. We also note that in general, the list of the top 5 goods for which the greatest price increase is noticeable has not changed for 14 months in a row. In October, 45.3% of respondents noticed a strong increase in prices for vegetable oil, 32.6% for vegetables and fruits, and 31.7% for sugar and salt in addition to the above-mentioned products. In general, we note that many more people noticed an increase in prices for many goods and services in October compared to September. In addition, there is a sharp monthly increase in the price of fruits by 5.9% MoM and vegetables by 3.7% MoM due to seasonal factors. We also note that meat became the most expensive commodity among staple foodstuffs in per year terms. Over the last year, meat prices increased by 9.5%, while overall food products showed growth of only 2.5% YoY.

Devaluation expectations rebound after record lows

The Kyrgyz som weakened by almost 2% in October after a slight strengthening in September. As a result, devaluation expectations of Kyrgyzstanis increased slightly after the absolute minimums of September. In the previous month, 23.1% of residents expected the national currency to weaken in a year, the share of such people increased to 25.4% in October. While, the share of pessimists increased from 14.4 to 17% in the matter of the US dollar’s growth in the one-month horizon.

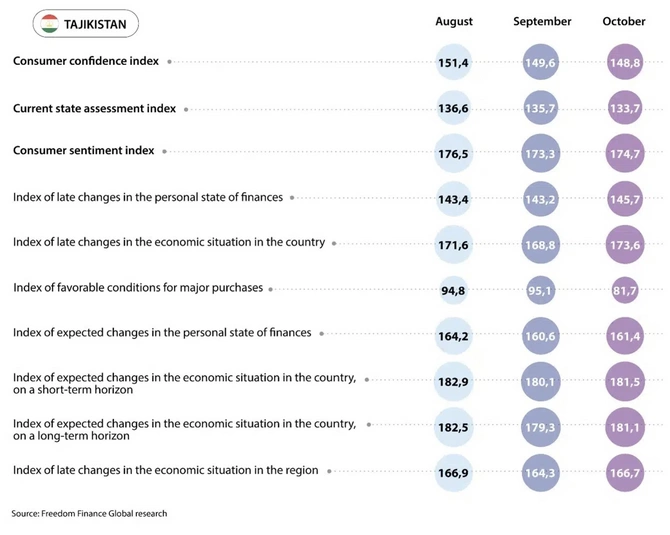

Tajikistan

In Tajikistan, the Consumer Confidence Index fell for the third time in a row in October: from 149.6 to 148.8 points. At the same time, four out of five sub-indexes showed growth, but a sharp decline in optimism about the favorable conditions for large purchases pulled the overall index down. Compared to last October, the CCI fell by 2.2 points, and again, largely due to a deterioration in the estimates of the favorable conditions for large purchases.

Conditions for large purchases have deteriorated sharply

The sub-index, which measures the current favorable conditions for large purchases and spending, fell by 13.4 points in October compared to September and reached 81.7 points. It is the worst figure in the past five months. More than 40% of respondents gave positive answers, while this figure was 45.6% in September.

Among the age groups, a decline was observed across all groups. It was especially noticeable among people over 60 and 30–44 years old. In September, the share of optimists among the older generation reached 49.9%, and it fell to 39.1% in October. However, respondents aged 30–44 demonstrated the worst result, this figure fell from 45.3 to 35.8% among them. Young people under the age of 29 demonstrated the greatest optimism, where 44.9% of respondents estimated the current conditions for large purchases as favorable.

In the regional context, deterioration is observed everywhere except for the Gorno-Badakhshan Autonomous Region, where the share of optimists increased from 45.3 to 51.7%, which was the best result in October. The largest decline occurred in the Khatlon region, where 39.1% of respondents believe that current conditions are favorable for large purchases (46.1% in September). However, the worst indicator of 35.8% is recorded in the regions of republican subordination.

Estimates of the economy have improved significantly

On the other hand, residents’ estimates of changes in the economic situation in Tajikistan showed the most noticeable improvement compared to September. This sub-index increased from 168.8 to 173.6 points, which was the second-highest result this year. The share of optimistic Tajikistanis was 85% in October versus 80.8% in September.

Among the age groups, an increase in the proportion of optimists was recorded in all age groups. It is most pronounced among residents of the country aged 30–44, where the share of those who positively estimate changes in the economy increased from 79.2 to 85.5%. Nevertheless, the best result is still recorded among the older generation over 60, where this share reaches 90.5%. In the other two age groups, the share of positive answers also exceeds 80%. However, respondents aged 45–59 gave the worst answers, whose result was the lowest in October (81.9%).

An increase in the share of residents who noted an improvement in the economic situation over the past 12 months was recorded in all regions except the Gorno-Badakhshan Autonomous Region. The above-mentioned region showed a share of positive responses of 83.7% versus 87.8% in September. The highest indicator of 86.4% was observed in the Khatlon region. At the same time, the largest monthly improvement in the indicator of 5.9 percentage points occurred there. Dushanbe residents again responded worse than others did; however, the share of positive responses increased from 76.5 to 80.4% there.

Inflation sentiment improved

Inflation estimates by Tajikistanis showed a good decline in October after a sharp increase in August and continued growth in September. The share of respondents who noted a strong increase in prices over the past month fell from 27.3 to 23.9%. Over the past 12-month horizon, the share of those who felt a faster increase in prices fell from 31.2 to 26.6%. Inflation expectations of Tajikistan residents showed a less significant improvement compared to September. Over 10% of residents expect a very strong increase in prices in the coming month, while there were 12% in September. Over the next 12-month horizon, the share of pessimists fell from 14.4 to 12.8%.

Official inflation data for October has not yet been published, but annual inflation slowed in September from 3.6 to 3.1%, which contradicts the continued growth of inflation estimates and expectations in the previous wave of the research. Among certain goods, residents of Tajikistan continue to be greatly concerned about the prices of meat and poultry. Over the past month, the share of people who have noticed a strong increase in prices for this category has increased from 50.8 to 58.1%, thereby updating the absolute record for the fifth month in a row. The level of concern for other food products has also increased significantly. For vegetable oil, this figure increased from 25.1 to 35.5%, and for flour, from 30.7 to 34.2%. It should be noted that the top 4 goods, along with vegetables and fruits, remained unchanged. According to official statistics, prices for meat and meat products continued to accelerate in September and increased by 1.9% MoM, and separately for beef by 3% MoM. Thus, prices for meat as a whole have already increased by 12.5% and for beef by 20.1% over the year. We note a rise in egg prices by 6.2% MoM in September, while the share of those who noticed a strong increase in prices for this product increased from 4.3 to 12% in October.

Devaluation expectations have grown slightly

In October, devaluation expectations showed generally a slight increase in Tajikistan but remained close to the average values of the previous 12 months. The US dollar – Somoni exchange rate remained virtually unchanged in October. The share of those expecting the national currency to weaken within a month increased from 15.8 to 18.7%. 23.1% of the country’s population expects weakening in the one-year horizon (24.5% in September).

Conclusions

October 2024 turned out to be mixed for the Central Asian countries. In Kazakhstan, the Consumer Confidence Index has grown for the second month in a row. However, the growth of the index was much more noticeable this time, and it reached its highest value in 2024. We note the improvement in forecasts and estimates of residents regarding changes in their personal financial situation. In addition, estimates of the favorable conditions for large purchases have recovered well. Positive dynamics of the index were also recorded in Uzbekistan. Moreover, the growth was not hindered by the September pause, and its pace has improved significantly. The index reached its best values since March of this year, after which there were sharp changes in the sentiments of Uzbekistanis. A significant improvement is noticeable in estimates of changes in the economic situation. Also, more residents believe that their financial situation has improved over the past year. Thus, the index decreased by only 1.9 points compared to last year’s October reducing the previous gap.

On the other hand, the CCI fell for the second month in a row in October in Kyrgyzstan. Recall that consumer confidence had previously been growing for six months in this country. In addition, the decline was more noticeable this time than in September, and the gap with Uzbekistan was significantly reduced. All this happened due to a decrease in positive opinion regarding changes in the economic situation, which had previously been the main driver of growth. In general, an increase in pessimism is also recorded in all other matters. Nevertheless, the index still shows a significant increase of 8 points compared to October 2023. The regional leader in the CCI, Tajikistan, has seen a slight decline for the third month in a row. Although the rate of decline was again insignificant, it is still worth noting the dramatic changes in the answers to individual questions. Residents’ estimates of the favorability of current favorable conditions for large purchases fell sharply to a five-month minimum. However, residents of the country showed an increase in optimism on the other four questions, thereby compensating for the noted decline. Compared to last year, the CCI shows a slight decrease of 2.2 points in Tajikistan.

In October, the dynamics of inflation estimates and expectations turned out to be positive across the region after negative August and September. Almost all countries recorded a decrease in pessimism on all matters regarding inflation, and some even set new record lows. The dynamics of inflationary sentiment turned out to be multidirectional only in Kazakhstan. Inflation expectations there continued to grow, while inflation estimates significantly decreased and set new record lows. In Kyrgyzstan, inflation estimates also significantly decreased after the sharp growth in September. Therefore, we can only talk about the normalization of indicators, but not about record lows there. In Tajikistan, similar dynamics with inflation estimates are also observed. However, the indicated changes are still significantly higher than the summer values, since growth was the highest in August – September in this country. In Uzbekistan, inflation estimates and expectations also fell, but not as significantly. In the same way, the estimates are still much worse than they were in July. Nevertheless, inflation expectations have reached a new low.

Devaluation expectations have generally shown growth in Central Asian countries. Almost all countries have seen a weakening of the national currency, except for Tajikistan. Note the continued growth of devaluation expectations in Kazakhstan after the September pause. At the same time, the indicators reached new absolute records for the entire research. In Uzbekistan, devaluation expectations also grew, but at a much slower pace. It happened amid a gradual weakening of the sum for the third month in a row. In Kyrgyzstan, there was a noticeable increase in devaluation expectations for the first time since March after a slight weakening of the som. Although the share of those expecting this to continue was within the average values of the previous six months. The dynamics were mostly neutral only in Tajikistan, although a few more people now expect the somoni to weaken in a month. On the other hand, the share of pessimists regarding the exchange rate over a one-year horizon has decreased.

The sixteenth wave of consumer confidence research in four Central Asian countries has shown mixed results across countries and key issues. A noticeable increase in consumer confidence is recorded in two countries, while the other two have seen the opposite. The reduction of the huge gap between Kyrgyzstan and Uzbekistan, which were in different positions a year ago, is particularly worth noting. This raises a question, the answer to which we will learn in the coming months: will another decline in the index in Kyrgyzstan mark the start of a negative trend? A similar, but opposite question arises for Uzbekistan, where growth has accelerated, and the CCI has approached the 2024 highs. Kazakhstan is also keeping up with its southern neighbor and has shown the best result this year. In Tajikistan, there has been a sharp and interesting change in the opinions of residents on certain issues, and it will also be interesting to see how this will affect the results in the following months. Another important event in this wave of research was the almost universal improvement in inflation estimates and expectations of the population after two months of negativity in a row. At the same time, it is still far from being possible to talk about a full recovery in a couple of countries. While, devaluation expectations showed widespread growth. Finally, October can definitely be called important for Central Asia in terms of structural changes in public sentiments.

Share on social media