The report, supported by the Astana International Financial Centre (AIFC), the National Payment Corporation of Kazakhstan, Mastercard, and KPMG Caucasus and Central Asia, offers insights into key trends, regulatory frameworks, and countries’ specifics in the digital assets market.

Google images

In just two years, the percentage of Kazakhstan's population owning cryptocurrencies has doubled, from 4% in 2022 to an estimated 8% in 2024, according to the latest digital assets market report for Central Asia and the Caucasus by RISE Research and Freedom Horizons, The Caspian Post reports citing foreign media.

The report, supported by the Astana International Financial Centre (AIFC), the National Payment Corporation of Kazakhstan, Mastercard, and KPMG Caucasus and Central Asia, offers insights into key trends, regulatory frameworks, and countries’ specifics in the digital assets market.

“The crypto industry in Central Asia and the Caucasus has been steadily growing, aligning with the global trend. The region has already established a regulatory framework that supports not only cryptocurrency trading but also the development of new blockchain-based business models,” said Freedom Horizons CEO Kairat Kaliev.

Dynamic digital assets sector

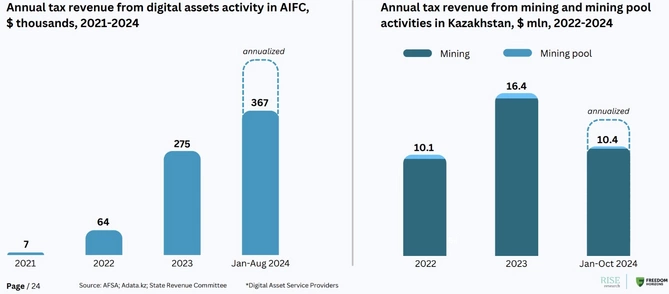

Tax revenues from Kazakhstan’s burgeoning digital asset sector have shown notable growth in 2024. Licensed digital asset providers operating under the AIFC contributed $367,000 in taxes over the first eight months of the year, compared to $275,000 in 2023.

Photo credit: screenshot from the report by Rise Research and Freedom Horizons

Crypto-mining activities added $10.4 million in tax revenue over ten months and $16.4 million in 2023.

As of October 2024, the AIFC hosts 11 licensed cryptocurrency exchanges, offering access to 112 cryptocurrencies through its FinTech Lab. Between January and October, trading activity on these platforms reached $815 million, with the number of registered users surpassing 140,000.

Uzbekistan leads Central Asia in cryptocurrency adoption

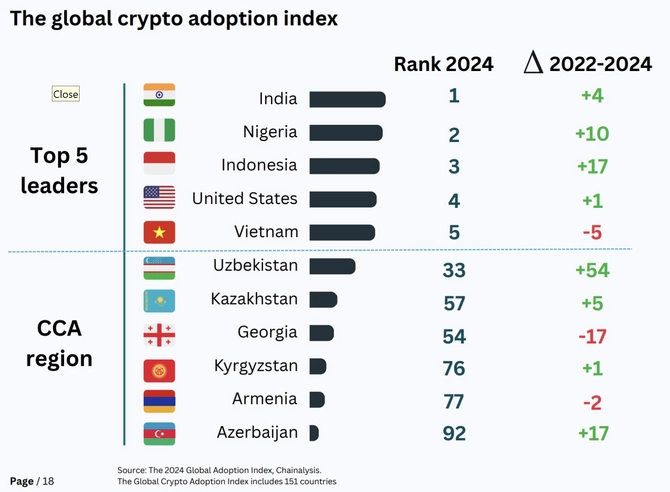

Kazakhstan ranked 57th in the 2024 Global Crypto Adoption Index, up five spots. Uzbekistan ranked 33rd, a notable leap of 54 positions, showing rapid progress in adoption. Globally, India ranks first in the index, followed by Nigeria, Indonesia, the United States, and Vietnam.

Uzbekistan is a standout performer in the region of Central Asia and the Caucasus. Photo credit: screenshot from the report by Rise Research and Freedom Horizons

The report notes Kazakh citizens opt for cryptocurrency assets because of the expanding value and popularity of cryptocurrency markets, the use of cryptocurrencies as a means for long-term investment, and a belief in blockchain technology to promote transparency and financial inclusion. For others, the possibility of high yields, particularly through decentralized finance, is a major draw.

In their analysis, experts also highlight the profile of cryptocurrency investors in Kazakhstan. The majority (83%) are men, with 17% women. Most investors are aged 18-34 (83%), with 47% in the 25-34 range. Income-wise, 78% are middle-income, 12% are high-income, and 8% are low-income.

Key barriers

Industry players surveyed in the report say that the development of the cryptocurrency market in Kazakhstan is inhibited by poor integration with the banking system and the reluctance of second-tier banks to work with crypto firms.

“According to our survey and interviews with market participants, the main barrier to the development of digital assets in Kazakhstan is limited access to banking services. Many banks are unwilling to work with companies in this sector, viewing them as higher-risk clients, which complicates transfers and account management,” said Ainur Zhanturina, founder of RISE Research.

Kazakhstan as a major player in Bitcoin mining

In October 2021, Kazakhstan became a major player in Bitcoin mining. After China banned cryptocurrency mining in 2021, Kazakhstan became increasingly attractive for miners because it had cheap electricity and fewer regulations at the time. But much of that mining was illegal.

Photo credit: screenshot from the report by Rise Research and Freedom Horizons

The report notes that Kazakhstan was responsible for 27.3% of the global mining activity as of October 2021, making it the second-largest Bitcoin miner in the world after the United States.

Bitcoin mining is a process in which powerful computers create new Bitcoins. This process uses a lot of electricity. In November 2021, the Kazakh government called for tighter measures to regulate crypto mining as it began to overwhelm the country’s electricity infrastructure. With the increased regulatory oversight, the market contracted to 4% in 2023.

In April 2023, Kazakhstan’s law on digital assets prohibited the use of unsecured digital assets, stablecoins, and security tokens, except within the AIFC framework.

Advanced banking sector

The report adds that Kazakhstan’s advanced fintech sector, with its sophisticated banking services and digital payment solutions, is a key reason for the limited crypto market size in the country.

High banking penetration, which was 81% in 2021, and widespread smartphone adoption at 83% in 2023 are complemented by a robust internet penetration rate of 92% as of 2024. Additionally, 89% of payments in the country are now cashless.

Fintech services in Kazakhstan are also efficient. On average, opening a bank account online takes less than three minutes, while digital lending approvals are processed in just around two minutes. The government’s GovTech initiatives enable composite services, such as purchasing and re-registering a car, to be completed online in under an hour.

Accelerating adoption of digital assets

The report also highlighted key global trends in the digital assets sector, demonstrating its significant growth and increasing institutional recognition.

The cryptocurrency market cap has surpassed $2.7 trillion, with over 580 million users worldwide. Nearly half of global consumers have used or are open to using cryptocurrencies as a payment method, signaling a growing interest in retail adoption.

More than 60 banks globally have invested in blockchain projects, and 93% of central banks are exploring Central Bank Digital Currencies (CBDCs). Kazakhstan is one of them.

By 2030, over $10 trillion worth of real-world assets are expected to be tokenized, showcasing a significant shift toward institutional use of blockchain technologies.

Of 60 surveyed countries, 33 have legalized cryptocurrency, while 17 partially ban it, and 10 enforce a general ban. Among G20 nations, 12 have legalized cryptocurrencies, representing over 57% of global GDP. Regulatory frameworks are under discussion in all G20 countries.

Share on social media

The report, supported by the Astana International Financial Centre (AIFC), the National Payment Corporation of Kazakhstan, Mastercard, and KPMG Caucasus and Central Asia, offers insights into key trends, regulatory frameworks, and countries’ specifics in the digital assets market.