Overall, the Covid-19 pandemic must be taken as an opportunity for reflection across the region.

Iran has been particularly hard-hit by Covid-19. Photo: Javad Esmaeili

Since the World Health Organization declared Covid-19 to be a global pandemic, about 100,000 lives have been lost in six Caspian Basin countries (Azerbaijan, Armenia, Georgia, Iran, Kazakhstan, and Turkey)[1]. But as well as the human toll, there have been significant social and economic disruptions.

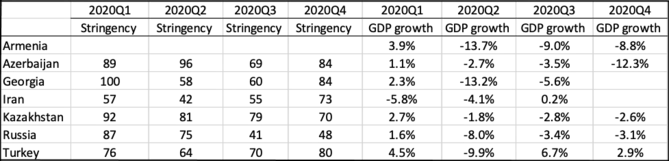

All Caspian Basin countries imposed travel restrictions starting in March 2020. According to Oxford University’s Stringency Index, Georgia and Kazakhstan had the highest restrictions in place by the end of March, followed by Azerbaijan at the end of June. After relaxing economic restrictions during the third quarter, almost all Caspian Basin Countries brought back the restrictions to fight the second and perhaps the strongest wave during November 2020. Quarterly economic performance seems to correlate with these restrictions, although not all restrictions were “created” equal.

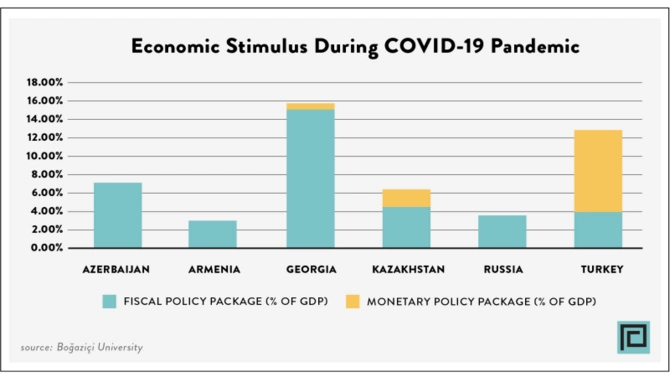

Overall, during 2020 the global GDP declined by 3.5% while economic output in the Middle East and Central Asia fell by 3%. As others did, the Caspian Basin countries adopted various fiscal and monetary packages in sizes ranging from 16% of GDP in Georgia to 3% of GDP in Armenia to stimulate their economies. Reduction in interest rates, direct monetary aid and loans to consumers and businesses were distributed. Extended fiscal support was given to intensely impacted industries like tourism and leisure.

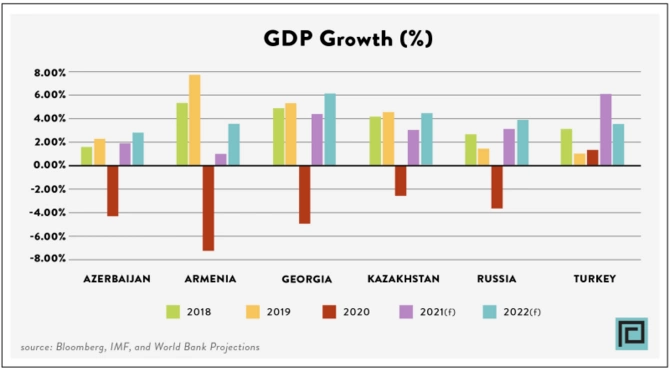

Despite these interventions, lockdowns and travel restrictions contributed to economic declines that ranged from 3% in Kazakhstan to over 7% in Armenia (Fig 2), though the latter was additionally impacted by the 2020 Karabakh War. Iran’s economy suffered further pressure from US sanctions following earlier contractions of 5.4% and 6.5% in 2018 and 2019 respectively. Only Turkey’s economy grew during 2020, a result of significant economic stimulus and public spending.

The good news is that, as multiple vaccines were being approved for use around the world, the International Monetary Fund (IMF) revised its global economic growth projection to 5.5% in its January update. By mid-March 2021 about 360 million doses had been administered across 122 countries. Turkey and Russia are among the top 10 countries for doses administered with around 10% and 5% of their respective populations already vaccinated. Azerbaijan leads the South Caucasus and Central Asia with about 4.5% of the population getting single-dose vaccinations. Looking forward, almost all the Caspian Basin countries are expected to grow during the 2021-2022 period.

Here’s the bad news. Shutdowns and various restrictions in 2020 significantly decreased business in restaurants, transportation, leisure, and accommodation services. For entertainment and recreation industries that rely on face-to-face interaction, 2020 has been devastating. These industries need both financial and human resources to get back to pre-Covid levels. But finding the right level of stimulus will prove tricky. If, as seems probable, demand grows more quickly than supply of goods and services, inflation could prove a headache for policymakers. But excessive tightening of monetary conditions and early withdrawal of fiscal support could stall the robust return of these businesses. It will be important to keep a balance between speedy recovery and early intervention to prevent the economy from overheating.

Oil producing countries (notably Azerbaijan, Kazakhstan, and Russia) have generally benefited from increasing oil prices in 2021. Also Azerbaijan and Turkmenistan stand to gain from recent decisions to jointly-operate long-disputed oil-and-gas fields in the Caspian. Iran is a special case, still struggling under heavy U.S. sanctions. It is possible that the Biden administration will expedite a new deal with Iran, allowing oil revenues to flow back into its economy, having a knock-on effect upon surrounding countries.

Higher oil prices will once again raise concerns about these countries’ appetites for structural reforms. When hydrocarbon prices plummeted in 2014-2015, not only did economic output decline, but capital moved away from local currencies to the perceived safety of the US dollar, amplifying fiscal and monetary issues. Essentially, the more multi-faceted an economy the more robust it is likely to be. Measured by Harvard University’s Atlas of Economic Complexity, the economies of Turkmenistan (106th) and Azerbaijan (124th) are currently amongst the world’s least complex due to their overwhelming dependency on natural resources. These countries should take advantage of high oil and gas prices now to gain financial flexibility and consider reforming their systems toward diversity.

In contrast, higher prices are bad news for oil-importing countries such as Turkey. Turkey suffers at present from double-digit inflation which makes the Turkish lira extremely unstable. To keep inflation under control the Turkish central bank has been raising interest rates, a practice that typically works against economic recovery. As the post-Covid economy reopens, the hope is that growing exports and tourism revenues will help stabilize the currency markets.

Another potential wild-card in the region’s economy is the re-shaped geopolitical situation in the Caucasus. While both sides, especially Armenia, suffered significant human losses, both countries stand to benefit from establishing economic ties, which is still a work-in-progress. In addition, Azerbaijan will need to make significant investments within the next 2-3 years into the rehabilitation of war-torn areas of the Nagorno-Karabakh and surrounding districts. As a part of that agreement, a new railroad is planned to connect Azerbaijan and Turkey via Armenia and another linking Russia and Armenia through Baku.

Economic theory suggests that three factors drive growth - population, capital investments, and productivity. With slowing population growth in the region, it is not surprising that productivity (measured as the annual output growth rate per worker) has been chosen as one of the metrics in assessing the 2030 UN Sustainable Development Goals. Based on the International Labour Organization (ILO)’s estimations, the six Caspian Basin countries rank between 41st (Turkey) and a lowly 106th (Azerbaijan) in terms of labour productivity. Oil economies should increase productivity in non-oil sectors to break away from the cyclicality of oil revenues.

Productivity is closely correlated with the availability of high quality of education that respects academic freedom, teaches 21st century skills, and fosters an innovative and entrepreneurial spirit. In the Scimago Rankings, which hint at countries’ academic achievements by tabulating the number of published research papers, Iran, Russia, and Turkey rank amongst the world’s top 20, but others Caspian nations fall far below. In what might be considered a fairer comparison, adjusted for countries’ income level, the WIPO Global Innovation Index shows only Armenia and Georgia to be performing above base expectations.

Investing in productivity and research and development requires a well-developed financial sector. According to the IMF’s Financial Development Index, only Turkey (ranking 33) and Russia (#39) have relatively developed financial markets. In contrast, the South Caucasus countries lack meaningful financial markets which hinders capital formation through financial markets. All Caspian Basin economies depend on foreign capital (oil revenues, portfolio or foreign direct investments) making the region vulnerable to external shocks. However, the current global financial environment offers some opportunities. Due to low interest rates and ample liquidity in developed countries, global investors find developing countries more attractive. But if interest rates rise further, especially in the U.S., more funds will flow out of emerging economies creating headwinds. The message for the Caspian region is thus a need to develop robust domestic financial markets. Building a successful public financial infrastructure also means seeking modern banking solutions and a pressing need for investing in innovative fin-tech.

Perhaps never before has the digital economy been as important as during the Covid-19 pandemic. Embracing technological advances in the financial sector is the key for increasing liquidity and offering effective risk management tools. Only Kazakhstan and Turkey rank among top 50 countries in digital competitiveness as ranked by the IMD. Digitalization is needed not only to improve the production and delivery of goods and services, but also to improve access to capital, especially for small and medium businesses that employ most of the working-age population.

Overall, the Covid-19 pandemic must be taken as an opportunity for reflection across the region. Policymakers need to coordinate monetary and fiscal policies to address enduring problems such as low productivity, inadequate access to healthcare, rising inequality and poverty, and low financial development. Investing in public-private partnerships and in education will build human capital with the 21st century skills needed for economic mobility.

[1] Turkmenistan is not included here due to data limitations

Share on social media