Photo credit: oilandgasmiddleeast.com

By Samir Muradov

A new strategic hub is emerging on the energy map of Eurasia. Turkmenistan, home to some of the world’s largest natural gas reserves, is making confident strides to strengthen its position in the global energy market. This is evidenced by the signing of a landmark deal involving the UAE and Malaysia-an agreement that could reshape the balance of power in the Caspian region.

This week, XRG, the international investment arm of Abu Dhabi’s oil giant ADNOC, announced the acquisition of a stake in the offshore gas field known as "Block I" in Turkmenistan’s sector of the Caspian Sea. The transaction is part of the emirate’s ambitious strategy to diversify its global energy portfolio and reduce its reliance on crude oil exports.

Photo credit: jobs.adnoc.ae

XRG has signed a long-term gas sales agreement with the state-owned company Turkmengaz, opening up new growth opportunities for Turkmenistan’s energy sector. While the financial details of the deal have not been disclosed, it is known that XRG has secured a 38% stake in the project. Malaysia’s Petronas retains a controlling 57% share, while Turkmenistan’s state-owned Hazarnebit holds the remaining 5%.

"Block I" is already delivering significant results, with daily production reaching around 400 million cubic feet of natural gas, equivalent to approximately 11.3 million cubic meters. However, XRG notes that this is just the beginning. The field’s reserves are estimated to exceed seven trillion cubic feet, positioning it as one of the most promising energy projects in the region.

A key element of the agreement is a production-sharing contract signed with Turkmenistan’s national oil company, Turkmennebit, providing the country with additional assurances of control over the development of its natural resources.

For the UAE, participation in this project is more than just a commercial venture. The emirate is positioning itself as a global energy powerhouse by investing in projects worldwide-from Africa to Central Asia. Founded in 2023 with $80 billion in assets, XRG has quickly emerged as one of Abu Dhabi’s primary vehicles for global energy expansion. The deal with Turkmenistan not only strengthens the UAE’s foothold in Central Asia but also opens access to key markets, particularly China and South Asia.

For Malaysia’s Petronas, the move reinforces its presence in the Caspian region, underlining its strategic interest in long-term gas projects beyond Southeast Asia. With global demand for natural gas rising as a cleaner transitional fuel, both countries anticipate strong returns from this project in the years ahead.

The deal represents a significant milestone in Turkmenistan’s strategy to bolster its energy sovereignty and expand its export geography. According to the State Statistics Committee of Turkmenistan, the country produced 77.6 billion cubic meters of natural gas and 8.3 million tons of oil in 2024. Turkmen authorities also highlight consistent growth in hydrocarbon processing, with bitumen production up by 10.2%, gasoline by 4.8%, fuel oil by 8.2%, and diesel fuel by 0.6%.

Photo credit: ief.org

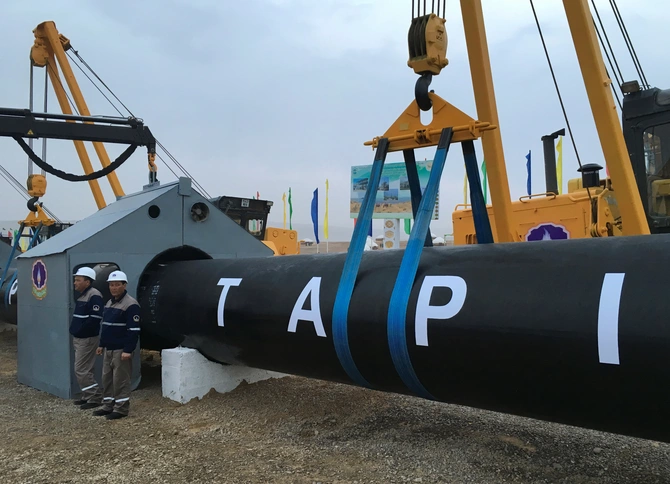

President Serdar Berdimuhamedov has outlined clear national priorities for the coming years, including the development of the giant Galkynysh gas field, the launch of new export routes, and the acceleration of the strategic Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline project. This pipeline aims to provide an alternative export corridor, reducing the country's dependence on the Chinese market.

Today, Turkmenistan and Russia are the primary suppliers of pipeline gas to China. Against this backdrop, Ashgabat is seeking not only to maintain its share in this vital market but also to expand exports to other regions. However, achieving these goals requires solving critical domestic challenges, including modernizing extraction technologies, intensifying geological exploration, and adopting advanced solutions to expand its resource base.

Strategic investment partnerships such as the deal with XRG and Petronas could serve as catalysts for the technological renewal of Turkmenistan’s oil and gas sector. The involvement of international partners with expertise and advanced technologies increases the country’s chances not only of boosting production but also of developing new fields in the future.

Amid the global energy transition and intensifying competition for Asian markets, Turkmenistan is steadily emerging as a key player in Eurasia’s gas market. The partnership with the UAE and Malaysia opens new horizons for the country-not only in attracting foreign investment but also in expanding its international trade relations.

Photo credit: vajiramandravi.com

If Turkmenistan succeeds in implementing its ambitious energy strategy-from scaling up production at its Caspian offshore fields to completing the long-awaited TAPI pipeline-the country stands to significantly elevate its geopolitical and economic standing on the global stage. By positioning itself as a reliable and diversified supplier of natural gas, Turkmenistan could become a crucial bridge linking the vast energy markets of East and West. Its unique geographic location offers the potential to serve not only China and South Asia but also extend its reach toward the energy-hungry economies of the Middle East and Europe. This would enable Turkmenistan to move beyond the role of a single-market supplier and transform into a multi-directional energy corridor, helping to stabilize regional energy security while maximizing its export revenues.

Moreover, such diversification would reduce Turkmenistan’s vulnerability to market fluctuations and political pressures from any single buyer, particularly China, which currently dominates its export portfolio. Successful implementation of these projects would also attract further foreign direct investment, modern technologies, and technical expertise, allowing the country to fully unlock the potential of its vast natural gas reserves. In doing so, Turkmenistan could emerge not only as a key energy exporter but as a strategic partner in shaping the future of Eurasian energy networks-solidifying its position as an indispensable player in the global energy transition.

Share on social media