Caspian Pipeline Consortium/Photo credit: Wikipedia

Amid global energy transformations and geopolitical instability, ensuring energy security has become a top priority for countries with substantial hydrocarbon reserves, The Caspian Post reports.

Kazakhstan, one of the largest oil producers in Central Asia, faces challenges stemming from its dependence on a limited number of export routes. Traditionally, the Caspian Pipeline Consortium (CPC), which runs through the territory of the Russian Federation, has been the main channel for transporting Kazakh oil, handling an enormous 55 million tons annually.

However, the recent Ukrainian drone attacks (February 17) on the CPC’s Kropotkinskaya station, coupled with past technical failures and political risks associated with this route, underscore the need for export diversification. In this context, cooperation with Azerbaijan, which is actively developing its energy infrastructure, emerges as a strategically vital direction for Kazakhstan.

CPC issues and their consequences

Kazakhstan’s Ministry of Energy has already stated that oil intake via the Caspian Pipeline Consortium is proceeding according to schedule.

In 2022, the CPC faced severe technical problems, leading to significant disruptions in Kazakhstan’s oil exports. In March of that year, a pipeline accident resulted in a loss of approximately 320,000 barrels per day, equivalent to 1.3 million tons.

Another breakdown in August 2022 led to an anticipated reduction of Kazakhstan’s oil supplies to global markets by 15 million tons-around 50% of the annual export volume planned for the pipeline. These disruptions negatively impacted the country's economic growth and exerted pressure on the national currency.

Now, due to Ukraine's attack, Kazakhstan may lose about $600 million, according to Kazakh expert Olzhas Baidildinov.

"CPC may reduce oil throughput from Kazakhstan by 30% for one and a half to two months. At a minimum, 30% of these revenues will not reach our budget this year. That’s about $600 million or roughly 300 billion tenge," the expert explained.

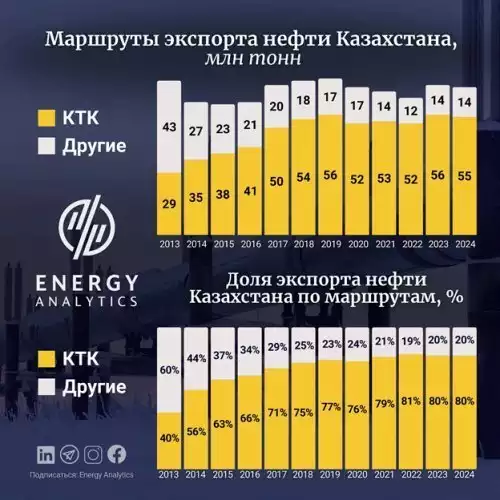

Infographics: ENERGY ANALYTICS

From 2013 to 2024, the CPC's share in Kazakhstan’s oil exports surged from 40% to 80%. The actual volume of oil transported through CPC rose from 29 million tons in 2013 to 55 million tons in 2024.

This significant increase in CPC’s share was also driven by a decline in volumes transported via alternative export routes. Such rapid expansion highlights the critical role CPC plays in the country’s export infrastructure.

Azerbaijan as an alternative

Given the need to diversify export routes, Kazakhstan has turned its attention to Azerbaijan, which is actively developing its energy infrastructure and export capabilities.

Azerbaijan plans to double its gas exports to Europe by 2027, as confirmed by agreements signed with European countries. President Ilham Aliyev has emphasized that Azerbaijan has sufficient resources to meet Europe’s energy needs for the next 100 years, thanks to major fields such as Shah Deniz and Azeri-Chirag-Gunashli.

Azerbaijan’s Ministry of Energy has reported that in 2024, the country’s oil exports grew by 6.2%, reaching 32.5 million tons, while gas exports increased by 5.8%, totaling 25.2 billion cubic meters.

The bulk of Azerbaijan’s energy exports were directed toward Europe (Bulgaria, Hungary, Greece, Germany, Spain, Italy, Romania, Serbia, Slovenia, Croatia): 1) oil exports: 18.4 million tons (+7.5% compared to 2023); gas exports: 12.9 billion cubic meters (+9% compared to 2023).

Despite its efforts to develop renewable energy sources, Azerbaijan remains heavily dependent on oil exports, which constitute a significant part of its economy. In 2024, the country hosted the 29th UN Climate Change Conference (COP29), signaling Baku’s ambition to strengthen its position in the energy market.

Azerbaijan’s energy export routes

To bolster its energy exports, Azerbaijan is actively expanding transport routes:

Southern Gas Corridor - a strategic artery for supplying gas to Europe via Türkiye.

Baku-Tbilisi-Ceyhan Pipeline - the primary route for delivering oil to global markets.

Black Sea Power Transmission Project - a major initiative signed by Azerbaijan, Georgia, Hungary, and Romania to facilitate stable electricity exports to the European Union.

As the geopolitical landscape continues to evolve, Azerbaijan is emerging as a key player in Eurasia’s energy axis, offering Kazakhstan a viable alternative for oil exports.

Amid Europe's efforts to reduce its dependence on Russian energy, Baku is strengthening its cooperation with the EU, signing strategic partnership agreements with Italy, Hungary, Romania, Bulgaria, and other countries.

According to the 2024 Energy Transition Index compiled by the World Economic Forum, Azerbaijan emerged as the leader among CIS and Caspian region countries, scoring 60.3 points (ranking 38th out of 120 countries).

Kazakhstan-Azerbaijan cooperation

In 2024, Kazakhstan signed an agreement with Azerbaijan to facilitate the transportation of oil via the Baku-Tbilisi-Ceyhan (BTC) pipeline.

This move opens new export opportunities for Kazakhstan, reducing its dependence on traditional routes while expanding cooperation with European consumers.

According to Azerbaijan’s Ministry of Energy, 2 million tons of Kazakh oil have already been transported through the BTC pipeline, with plans for gradual volume increases.

Both nations are placing significant emphasis on developing transport and logistics infrastructure. Notably, freight traffic along the Middle Corridor grew by 65% in 2023, reaching 2.8 million tons, underscoring the route’s importance for regional trade.

Additionally, the presidents of Kazakhstan, Azerbaijan, and Uzbekistan have signed a strategic agreement on interconnecting their energy systems. This initiative aims to create reliable supply corridors for clean energy to Europe and other global markets.

The energy sector remains a key area of cooperation between Kazakhstan and Azerbaijan.

Expert opinions highlight the importance of diversifying Kazakhstan’s export routes to enhance energy security. Zaur Gahramanov, advisor to the president of Azerbaijan’s state oil company SOCAR, noted that Azerbaijan plans to increase the transit of Kazakh oil through its territory to 5-7 million tons per year, significantly exceeding previous levels. Kazakh President Kassym-Jomart Tokayev has also stressed the need to strengthen the Trans-Caspian International Transport Route (TITR) as part of broader diversification efforts.

Source: Baige News | Photo by Arman Mukhatov

Kazakh political analyst Andrey Chebotarev, Director of the Alternative Center for Current Studies in the interview for The Caspian Post, emphasized that while diversifying Kazakh oil exports is strategically significant, Kazakhstan has long utilized multiple export routes, including Russian, Chinese, and the Azerbaijan-Türkiye route via the Baku-Tbilisi-Ceyhan (BTC) pipeline.

Despite these efforts, Russia remains Kazakhstan’s dominant transit route. Oil is transported through the Caspian Pipeline Consortium (CPC), the Tengiz-Novorossiysk pipeline, the RAU-Samara system, and maritime shipments to Makhachkala via the Caspian and Aktau ports. Kazakhstan’s reliance on Russia is primarily transit-based, with most of its oil passing through Russian territory. However, Russia is not just a transit country but an active participant in the process. It imports part of Kazakhstan’s oil via the RAU-Samara and Makhachkala routes, while Russian companies, including Transneft, hold shares in the CPC.

Issues with CPC operations have escalated since 2022 due to political tensions following the Russia-Ukraine conflict, leading to disruptions in the intake and shipment of Kazakh oil via Novorossiysk. The recent Ukrainian drone attack on the Kropotkinskaya oil pumping station further exposed the vulnerabilities of the CPC route. However, if the conflict is resolved or shifts toward peace negotiations, risks associated with the CPC’s oil transport could decrease.

The BTC pipeline presents an uncertain alternative. Kazakhstan initially joined the BTC consortium in 2006 but later withdrew due to unfavorable tariffs. Western shareholders raised transit costs, and Kazakhstan never secured a stake in the consortium despite U.S. encouragement to participate. Unlike the CPC, where Kazakhstan holds shares, in the BTC pipeline, Kazakhstan is merely a supplier without an equity stake.

Over time, Kazakhstan's BTC shipments have fluctuated due to economic and political conditions. In 2023, the country renewed its commitment to the BTC pipeline under its diversification strategy, but this decision appears more politically motivated than economically driven.

The Baku-Tbilisi-Ceyhan (BTC) pipeline presents a costly alternative for Kazakhstan. Oil must first be transported by tankers from Aktau to Baku before being loaded into the pipeline system. Kazakhstan lacks the necessary fleet for these operations, making transportation expensive.

Additionally, Kazakhstan’s key oil fields, particularly Tengiz, are primarily oriented toward exports via the CPC pipeline. The Tengizchevroil project involves not only KazMunayGas but also global oil giants such as Chevron and ExxonMobil, both of which are shareholders in the Caspian Pipeline Consortium (CPC).

When considering real export volumes, the difference between CPC and BTC supplies remains massive. While oil export diversification remains an important issue for Kazakhstan, alternative routes cannot fully replace the Russian direction at this stage.

Photo: t.me/eldanizgusseinov

Eldaniz Huseynov, an analyst and co-founder of the political foresight consulting firm Nightingale Intelligence, shared his perspective on recent CPC-related developments and the possibility of diversifying oil supply routes in an exclusive comment for The Caspian Post.

According to him, CPC has no viable alternative today, and discussions about alternatives are more relevant in the context of Kazakhstan’s rising oil production. Up to 80% of Kazakhstan’s oil is transported via the CPC, making the security of this pipeline a national priority.

"I would immediately urge colleagues to refrain from statements suggesting that Kazakhstan must urgently diversify its oil transportation routes. The data analysis clearly shows that at this stage, diversification is practically impossible-unless oil exports to China are expanded or an underwater pipeline across the Caspian is built, which is highly unlikely in the foreseeable future," Huseynov emphasized.

Kazakhstan cannot significantly increase oil exports without Russia’s involvement in such projects. However, an image of an alternative scenario is being actively created. Kazakhstan aims to increase oil exports via BTC from the current 1.5 million tons to 20 million tons annually.

According to Kazenergy's baseline scenario, Kazakhstan’s oil production is expected to peak at 105 million tons in 2025, following the completion of the Tengizchevroil expansion project. After reaching this peak, production will gradually decline to 72 million tons by 2050. In 2022, oil production stood at 84.5 million tons, while the 2023 projection was 90.5 million tons. By 2050, 60-70% of total oil output will originate from Kazakhstan’s three major oil fields-Tengiz, Kashagan, and Karachaganak.

Despite this, Kazakhstan is expected to continue exporting 70-80% of its oil until 2050, with at least 70% of these exports transported via the CPC pipeline. Other key export routes include the Atyrau-Samara pipeline via Russia, expected to handle at least 8% of total exports, the Kazakhstan-China oil pipeline, projected to increase its share to 10%, and the BTC pipeline via Azerbaijan, with its share expected to grow to 6%.

Declining Azerbaijani oil exports via BTC remain a noteworthy trend. From January to October 2024, BTC exports dropped by 4% compared to the previous year, totaling 24.18 million metric tons. The pipeline mainly transports oil from the Azeri, Chirag, and Gunashli fields, operated by BP. Of the total 32.1 million tons of oil transported via Azerbaijan during this period, BTC accounted for 75.3%.

Meanwhile, Kazakhstan and Turkmenistan have increased their oil transit through BTC. From January to October 2024, transit oil from these countries reached 4.475 million tons, compared to 4.27 million tons in the same period of 2023. BTC’s total annual capacity is projected at 50 million tons.

To enhance its energy security, Kazakhstan should consider expanding transport corridors by utilizing the Baku-Tbilisi-Ceyhan (BTC) pipeline, helping to diversify oil export routes and reduce reliance on Russian transit. Developing the Trans-Caspian route in collaboration with Azerbaijan could provide greater access to European markets for Kazakh oil. While Kazakhstan’s diversification efforts are politically strategic, Russia’s role remains dominant in the country’s energy exports.

Kazakhstan could explore joining the Black Sea Energy Cable project, initiated by Azerbaijan, to export electricity to the EU. Developing new high-voltage transmission lines would significantly increase export capacity and provide an alternative energy supply route to European markets. Attracting major investors into solar and wind energy could follow Azerbaijan’s model, which has been constructing large-scale renewable energy projects. Actively engaging in international climate initiatives would strengthen Kazakhstan’s position in the global green energy transition, making the country an attractive destination for sustainable investments.

Leveraging Azerbaijan’s transit infrastructure could also allow Kazakhstan to export gas to Europe via alternative routes, helping the country adapt to global energy market shifts. In the 21st century, energy is no longer just an economic factor-it has become a key geopolitical tool.

As a major oil-producing nation, Kazakhstan finds itself in a complex position. On one hand, it has a historical dependence on the Caspian Pipeline Consortium (CPC), which links the country to global markets via Russia. On the other hand, growing international instability necessitates export diversification. The CPC disruptions in 2022 exposed vulnerabilities in the existing system, demonstrating that Kazakhstan could suddenly lose a significant portion of its oil exports, resulting in economic losses and currency devaluation pressures. This crisis proved the urgent need to explore alternative routes that could reduce risks while unlocking new economic growth opportunities.

Azerbaijan is a strategic partner for energy diversification. Cooperation with Azerbaijan represents a logical and strategic move. The Baku-Tbilisi-Ceyhan (BTC) pipeline has already proven to be a reliable transportation route, ensuring stable oil supplies to Europe. Integrating Kazakhstan into this infrastructure could allow the country to reduce dependence on Russian transit routes and mitigate geopolitical risks, secure stable access to European markets, especially as the EU reduces Russian oil imports, develop its own transportation infrastructure, enhancing Kazakhstan’s long-term investment appeal, and strengthen political independence by gaining greater control over export flows.

In today’s rapidly changing global environment, strategic inertia is no longer an option. Nations that fail to adapt to emerging challenges risk becoming vulnerable in the evolving energy landscape. By reducing dependence on the CPC and developing new export routes through Azerbaijan and the South Caucasus, Kazakhstan has the opportunity to enhance energy security, increase global market influence, and build a foundation for sustainable economic growth.

However, diversification is not merely a technical adjustment-it represents a deep political and economic transformation. Kazakhstan’s success in this transition will depend on the government’s commitment to bold reforms, strategic partnerships with neighboring countries, and active participation in global energy processes. By embracing a forward-thinking approach, Kazakhstan can position itself as a key energy player in Eurasia, ensuring long-term stability and economic prosperity.

Share on social media