@minfin.kg

The Ministry of Finance of Kyrgyzstan has reviewed its financial results for 2024 and outlined plans for 2025.

Finance Minister Almaz Baketaev stated that the country's recent financial policies have been crucial in revitalizing the economy, The Caspian Post reports citing foreign media.

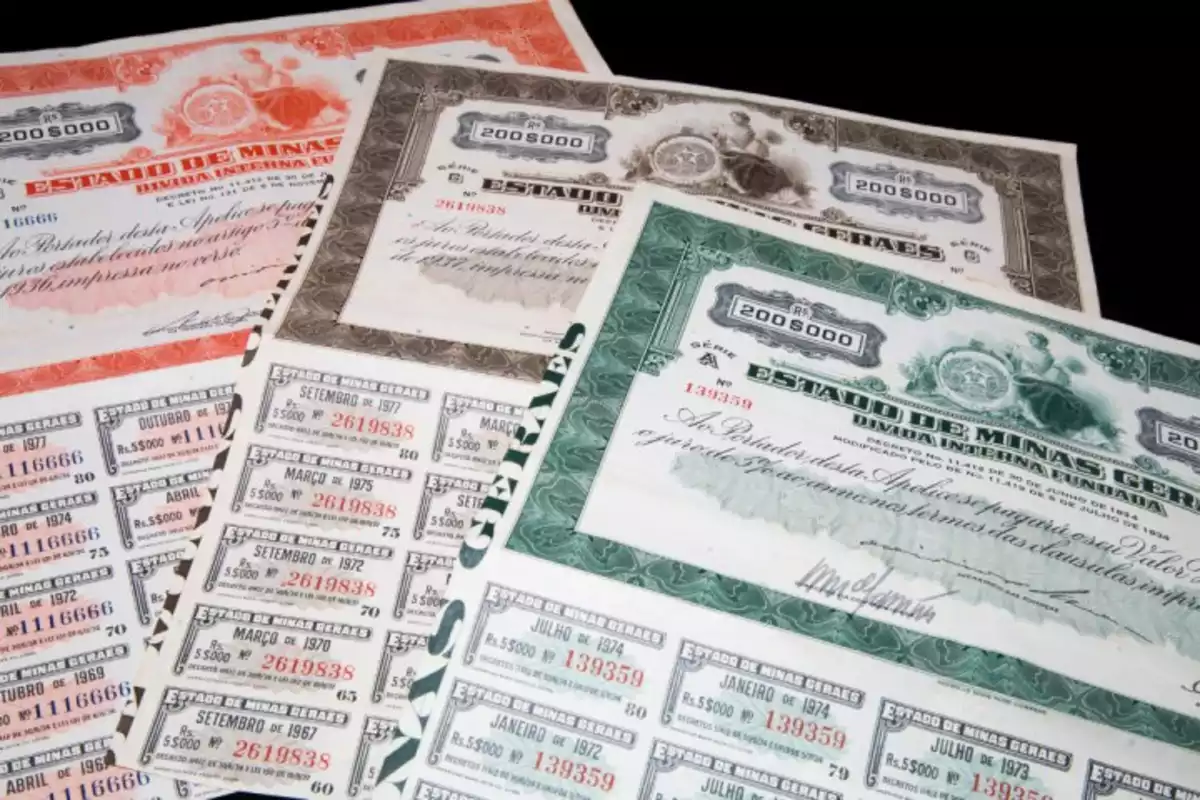

First-Ever Eurobond IssuanceFor the first time, Kyrgyzstan is preparing to issue Eurobonds worth $1.7 billion with a 10-year maturity period. The bonds will be denominated in U.S. dollars, euros, Chinese yuan, UAE dirhams, Hong Kong dollars, and the Kyrgyz som.

Earlier, The Times of Central Asia reported that the government was working on issuing European and American bonds, though at the time, the Ministry of Finance had not provided specific details. Now, the scale and scope of the plan have been confirmed.

“This issuance will be aimed at implementing priority projects in the energy sector,” said Umutzhan Amanbayev, director of the Central Treasury at the Ministry of Finance.

Investment and Economic Growth Strategy

The Ministry of Finance believes that Kyrgyzstan’s stable budget surplus, improving economic indicators, infrastructure development, and large-scale reforms continue to enhance its position in global financial rankings, attracting greater attention from international investors.

The Treasury has emphasized that strengthening the country’s financial and economic foundation will require:

These measures, officials argue, will help sustain economic growth and ensure long-term stability.

Growing Role in Financial Markets

Kyrgyz authorities have begun actively engaging with international financial markets to attract investment. In 2024, the government issued green bonds to fund environmental projects. Additionally, Kyrgyzstan is working on integrating its stock exchange with those of the Eurasian Economic Union (EAEU) countries.

The recent decision by S&P Global Ratings to assess Kyrgyz government securities has further bolstered interest in the country’s financial instruments, enhancing the appeal of Kyrgyzstan’s sovereign bonds.

Share on social media