photo: Swissinfo

Sanctions imposed by the United States against Russia’s oil giants Lukoil and Rosneft have triggered ripple effects across Eastern Europe and Central Asia, forcing countries deeply tied to Russian energy operations to make rapid, strategic decisions.

While Washington hopes the pressure will push Moscow toward negotiations over Ukraine, the fallout threatens regional energy security far beyond Russia’s borders. Bulgaria and Kazakhstan, both major partners in Lukoil’s international business, are now navigating an economic and political minefield, with billions of dollars in assets at stake.

President Donald Trump insists that the sanctions will weaken the Kremlin’s leverage. “I’ll say more in six months. We’ll see how they deal with all of this,” he remarked after Vladimir Putin downplayed the economic impact. But while the United States remains untouched, it is Russia’s neighbors and U.S. allies who are now grappling with uncertainty. Markets reacted immediately: Lukoil shares dropped 6.5% this week, falling to their lowest level since mid-2023.

Photo: The Moscow Times

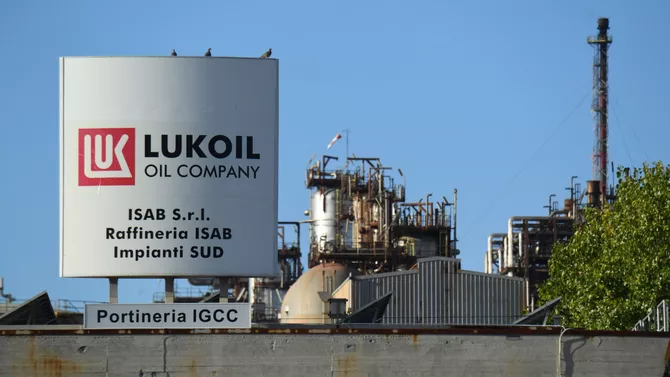

Lukoil moved quickly, announcing on October 27 that it is preparing to sell foreign assets across multiple jurisdictions. A formal review of potential buyers is already underway, but the company’s options are limited and politically constrained.

The urgency is most visible in Bulgaria, where Lukoil owns Neftochim Burgas, the largest refinery in the Balkans and a crucial pillar of the country’s fuel supply. Fearing that the company might try to offload its assets in a distressed sale, Sofia has tightened its control. A recently adopted bill requires that any transaction involving Lukoil undergo national security review and receive explicit government approval. Effectively, Bulgaria has reserved the right to block or freeze any sale it considers risky.

Analysts say the move paves the way for a de facto nationalization of the Burgas refinery. Even if Lukoil manages to find a buyer, the proceeds will not flow back to Russia, but will instead be deposited into frozen accounts under U.S. sanctions rules until further notice.

“From Sofia’s perspective, this is about energy independence and protecting critical infrastructure from external pressure,” said a European energy analyst familiar with the situation.

The refinery is already under strain. With Bulgarian legislation prohibiting imports of Russian crude, Neftochim Burgas has been forced to switch to oil sourced from Kazakhstan, Iraq, and several African producers - a logistical shift that contributed to heavy losses in 2023. The refinery also operates a broad downstream network of fuel stations and storage facilities, making its future central to Bulgaria’s wider economic stability.

Photo: Daily Sabah

The geopolitical maneuvering around Lukoil’s assets has drawn new interest from regional players. Earlier this year, Azerbaijan’s SOCAR, together with Türkiye’s Cengiz Holding, expressed readiness to bid for the Burgas refinery, a deal that would expand Baku’s influence in Europe’s energy security architecture and strengthen Türkiye’s refining footprint in the Mediterranean. Whether Washington would approve such a transaction remains unclear, but sources say Western diplomats are closely monitoring the pool of potential buyers.

Meanwhile, Kazakhstan faces its own dilemma. Lukoil is deeply embedded in the country’s strategic oil and gas projects, including stakes in the massive Tengiz and Karachaganak fields, as well as participation in the Caspian Pipeline Consortium, a key route for Kazakh crude to reach global markets. If Lukoil’s interests are frozen or forced into divestment, Kazakhstan risks supply disruptions and contractual complications.

Reuters reports that Astana has begun consultations with legal and financial advisors to determine the best course of action. Deputy Energy Minister Sanzhar Zharkeshov said that the national oil company KazMunayGas will take the lead in deciding whether to buy out or redistribute Lukoil’s shares in joint ventures. “The situation is being evaluated, and a decision is expected by the end of the week,” he stated.

For Kazakhstan, the stakes are not merely financial. Lukoil has been a partner since 1995, bringing technology, investment, and export access to some of the country’s most important hydrocarbon assets. Disrupting that relationship could undermine long-term development, including future offshore production at the Kalamkas-Sea and Khazar fields, where first oil is expected in 2028-2029.

Photo: Rogtecmagazine

Energy experts warn that Washington’s move could trigger a cascading restructuring of ownership across Eurasian energy networks. Companies from China, India, Türkiye, and the Middle East could seize the opportunity to acquire assets previously dominated by Russian firms, shifting geopolitical dependencies in the process. For now, however, uncertainty prevails.

“Sanctions are a powerful tool, but they come with unintended consequences,” notes Kirill Bakhtin, senior analyst at BCS. “If ownership of key energy infrastructure enters a prolonged legal freeze, local economies, not Russia, will bear the brunt of the instability.”

The U.S. Treasury has temporarily authorized transactions with Lukoil until November 21, provided payment funds are held in frozen accounts. Deals already initiated before sanctions were imposed on October 22 may proceed without additional approvals, while any new bidders must obtain special licenses. This narrow window has triggered a tense race among governments and corporations trying to secure assets before regulatory doors close.

Bulgaria has hinted it may impose external management on Lukoil’s assets to safeguard national energy needs. Kazakhstan, meanwhile, remains cautious - eager to avoid antagonizing either Washington or Moscow while protecting its future production and exports.

Lukoil still owns two refineries in Europe - in Bulgaria and Romania, as well as a major stake in a refinery in the Netherlands. Should broader sanctions expand, their fate may soon join the growing list of unresolved questions.

What is clear is that the U.S. decision has reshaped the region’s energy map overnight. For Bulgaria and Kazakhstan, the challenge is now to reduce exposure to Russian capital while maintaining stable fuel supplies and protecting domestic economies. For the global oil market, uncertainty is likely to become the new normal with consequences that extend far beyond the war in Ukraine.

By Tural Heybatov

Share on social media