Photo credit: strategeast.org

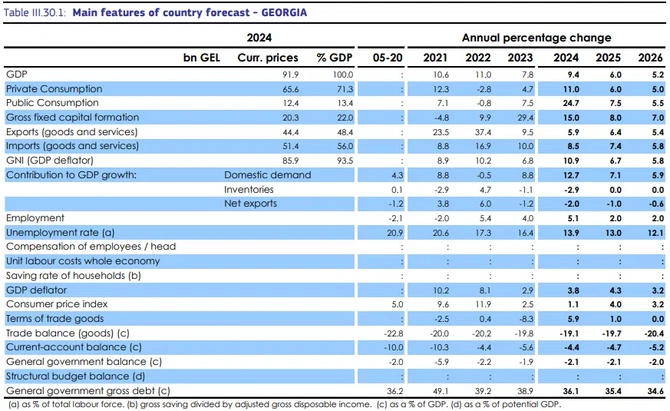

According to the European Commission’s 2025 Economic Forecast released on May 19, Georgia’s economic growth is expected to slow down but remain strong, reaching a “robust 5-6%” in 2025 and 2026, partly due to positive spillover effects from Russia’s war of aggression against Ukraine.

While the Commission expects growth will be contributed to consumer lending, business loans, and strong public investments, it warns that the outlook is subject to “an unusually high degree of uncertainty” stemming from Georgia’s domestic political developments and wider geopolitical tensions, which “may adversely affect business and consumer sentiments,” The Caspian Post reports citing Civil Georgia.

The report says that political turmoil in Georgia has been a key factor in deteriorating business confidence in the country.

Source: European Economic Forecast (2025)

Robust Economic Growth, Driven by Consumption

The report cites the country’s 2024 statistics, saying that Georgia’s economic growth stood at 9.4%. It was driven largely by surging private and the GD government consumption, strong wage increases, employment growth, and raising consumer loans.

On the supply side, the report notes that the growth was concentrated in ICT, construction, tourism, and transport, sectors that continue to benefit from “the reallocation of certain services and trade routes away from Russia following its full-scale war of aggression against Ukraine, reflecting in part a sizeable inward migration from Russia.”

Labor Market Situation Improvement, Wage Increase

The unemployment rate fell significantly, the report notes, from 16.4% in 2023 to 13.9% in 2024, and it is expected to continue to decline, albeit at a slower pace. Real wages increased by 15% in 2024 due to several factors, including the influence of high-skilled Russian migrants (notably IT specialists), Georgian companies’ efforts to compensate for rising living costs and labor shortages in certain sectors, and the decrease in inflation.

“Wage growth is expected to ease in the next years, but to remain higher than productivity growth,” the report argues.

Inflation Picked Up Temporarily

Despite decreased inflation rates in 2024, the report notes that it rebounded to 3.4% in April 2025 and is expected to reach 4% for the year. The acceleration of consumer prices, the report says, can be attributed to the pass-through from wage increases and from the limited depreciation of the lari, as well as to base effects.”

With expected fading of these factors, the inflation is set to return to the central banks, target of 3% in 2006.

Narrower Current Account Deficit

The report cites that Georgia’s current account deficit narrowed to 4.3% of GDP in 2024 from 5.6% in 2023. It notes that goods exports rose 6% amid stronger demand for metallurgical products and re-exported cars, while imports also rose in line with domestic demand for investment and consumer goods.

The deficit is expected to “slightly widen” in 2025 and 2026, with the surplus in services to rise, due to the increasing inflow of tourists, “which does not seem to be affected by the political developments in Georgia, while the trade deficit is set to increase as imports are projected to grow faster than exports.”

Limited Fiscal Deficit

The Commission’s report says that in 2024, the general government deficit accounted for 2.1% of GDP, below the 2.5% target. It was mainly boosted by wage increases, which stimulated personal income tax revenues, as well as higher gambling fees and taxes from the banking sector.

Meanwhile, the government spending grew by 20%, mainly due to higher public sector wages and interest payments. Capital spending, already at a high level, rose by another 10%.

The document notes that the government’s debt stood at 36.1% of GDP in December 2024 and is projected to decline further in the coming years. The Commission expects the budget deficit to remain around 2% of GDP through 2026, “well below 3% of GDP ceiling from the country’s fiscal rule.”

Share on social media