Photo credit: dknews.kz

By Maria Zhigadlo

The Caspian Post presents an interview with Kazakhstani expert and blogger Alzhan Ismagulov.

- What are the advantages and challenges of building a nuclear power plant in Kazakhstan? How will the introduction of nuclear energy affect the country's energy balance? Will a nuclear power plant fully cover the growing electricity deficit?

- Chairman of the Board of Samruk-Energy JSC, Serik Tyutebayev, stated at a meeting of the Public Council of the National Wealth Fund "Samruk-Kazyna" that by 2029, Kazakhstan's electricity deficit could exceed 3 GW. Currently, the country is already facing a shortfall of 1.2 GW and is forced to import electricity from Russia.

To address this issue, Kazakhstan has decided to construct several nuclear power plants and implement modernization projects for existing power stations, as well as build new ones with a total capacity of 4.1 GW.

During a recent government meeting, it was announced that by 2035, Kazakhstan plans to commission 26.5 GW of new capacity. Minister of Energy Almassadam Satkaliyev reported that in addition to the first nuclear power plant, which will be built on the shores of Lake Balkhash, a second plant is being considered, likely in Kurchatov. However, no referendum on the construction of the second NPP is planned.

Furthermore, according to the minister, at least three nuclear power plants will be necessary to ensure the country's energy security, and the choice of sites will be determined by the overall nuclear power plant deployment strategy.

Timur Zhantikin, General Director of Kazakhstan Nuclear Power Plants LLP, emphasized that the total nuclear power generation capacity in Kazakhstan should not exceed 2.8 GW. Even if two nuclear power plants with a capacity of 2.8 GW each are built, this will not be sufficient to fully resolve the electricity deficit by 2035, especially given that the construction of each plant takes approximately eight years.

- Which contender will Kazakhstan choose? What factors will be decisive in selecting the general contractor for the nuclear power plant construction-technology, economic conditions, or geopolitical considerations?

- In January, it was announced that Kazakhstan had completed its review of proposals from potential contractors for the construction of the nuclear power plant. Initially, it was planned that the final selection process would take up to two years-until 2026. However, the growing energy deficit prompted President Kassym-Jomart Tokayev to instruct the government to expedite the contractor selection process.

Almost immediately after this announcement, Director General of the State Atomic Energy Corporation Rosatom Alexei Likhachev stated that Russia and Kazakhstan were "moving toward joint solutions" regarding the nuclear power plant project. Shortly thereafter, a Kazakhstani delegation visited the Leningrad NPP to familiarize themselves with the VVER-1200 reactor technology. Before visiting Russia, Kazakhstani specialists also traveled to South Korea, France, and China to review the proposals of these countries.

- What is the significance of Rosatom’s participation in the project? What are its chances of winning the tender, considering the competition from Chinese and Western corporations?

- Along with Russia’s Rosatom, other shortlisted bidders for Kazakhstan’s nuclear power plant project include South Korea’s KHNP, China’s CNNC, and France’s EDF.

Russia is offering its Generation III+ VVER-1200 reactor, which was first commissioned in 2016 and is currently operational at Novovoronezh NPP-2 and Leningrad NPP-2. The VVER-1200 combines the reliability of well-proven engineering solutions with a comprehensive set of active and passive safety systems, designed to meet post-Fukushima requirements. Active systems are designed for rapid response to potential emergency situations, while passive systems ensure accident containment without operator intervention. According to the International Atomic Energy Agency (IAEA), the VVER-1200 meets all international safety standards.

To date, over 80 VVER reactor units have been built in Russia and abroad. Rosatom also has the world’s largest portfolio of international orders, comprising 34 reactor units in 11 countries. Additionally, Rosatom has developed advanced spent nuclear fuel reprocessing technology under the "Breakthrough" project, which gives it a significant competitive advantage as a potential contractor for Kazakhstan's NPP.

France encountered major difficulties during the construction of the Olkiluoto NPP in Finland, where the project significantly exceeded its initial budget and timeline. Moreover, the plant continues to face technical issues, making the selection of a French contractor highly unlikely.

American companies GE-Hitachi and NuScale were eliminated from the shortlist as they lacked experience in industrial-scale operation at the time the selection process began.

China is offering the Hualong One (HPR-1000) reactor, which was developed in the 2000s based on the ACPR-1000 (an evolution of France’s 900 MW reactor series) and the ACP1000 (a development of China's domestic reactor line). Currently, only six Hualong One reactors are operational in China, with an additional 13 under construction.

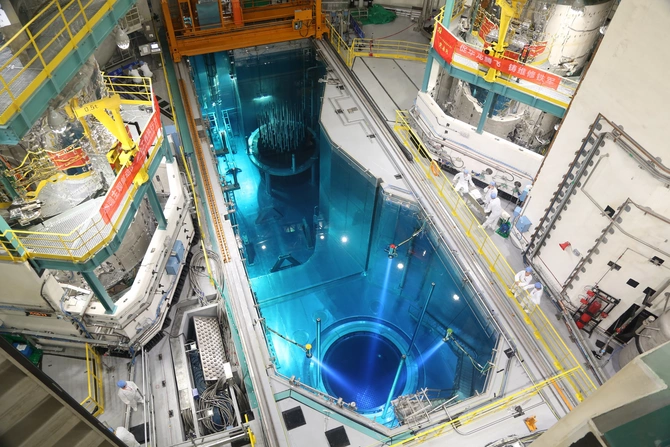

China’s Hualong One nuclear reactor/Source: Xinhua

South Korea is proposing the APR-1400 pressurized water reactor, with a capacity ranging from 1,345 to 1,400 MW, developed by KEPCO in the 1990s based on the OPR-1000 and the System 80+ reactor technology from the American company Combustion Engineering (C-E). Currently, only four APR-1400 reactors are operational, while two are under construction. Furthermore, KEPCO’s reactors are embroiled in legal disputes with the American company Westinghouse, which poses potential political and financial risks.

Based on this information, it is evident that Rosatom's proposal best aligns with Kazakhstan’s long-term plans for constructing three nuclear power plants. Kazakhstan requires a contractor with an extensive order portfolio, cutting-edge nuclear reactor technology, and an impeccable track record in the nuclear industry.

- How will the development of nuclear energy impact Kazakhstan’s economy? Could Kazakhstan eventually become an electricity supplier to neighboring countries?

- If Kazakhstan successfully implements its plans to expand electricity generation by 2035-not only in nuclear energy but also in hydropower, thermal power plants, and renewable energy sources-the country could potentially become an electricity exporter to neighboring states.

However, the primary goal remains to meet Kazakhstan’s own energy needs. Developing domestic power generation capacity will reduce dependence on imports and create favorable conditions for industrial growth by ensuring competitively priced electricity. The cost per kilowatt-hour is a crucial factor in production costs, and lowering it will enhance the competitiveness of Kazakhstani goods in the global market.

Share on social media